You must have heard several tragic love stories; however, the one we are going to discuss today hits home. Neha Unnikrishnan and her husband, Major Sandeep Unnikrishnan, were married for a couple of years until her world shattered right in front of her eyes.

Sandeep Unnikrishnan was a brave Indian Army officer killed during the 26/11 Mumbai terror attacks on the Taj Mahal Palace Hotel when Pakistan attacked India. While she prefers to keep a low profile and has successfully maintained a distance from the public eye, we have tried to gather some information about her life.

Who is Major Sandeep’s wife?

However, there is no information regarding her birth date. Besides, the identities of her parents and siblings are also unknown to the world.

Moreover, she went to a local school from where she acquired her early education. After that, she joined a college and graduated with a degree.

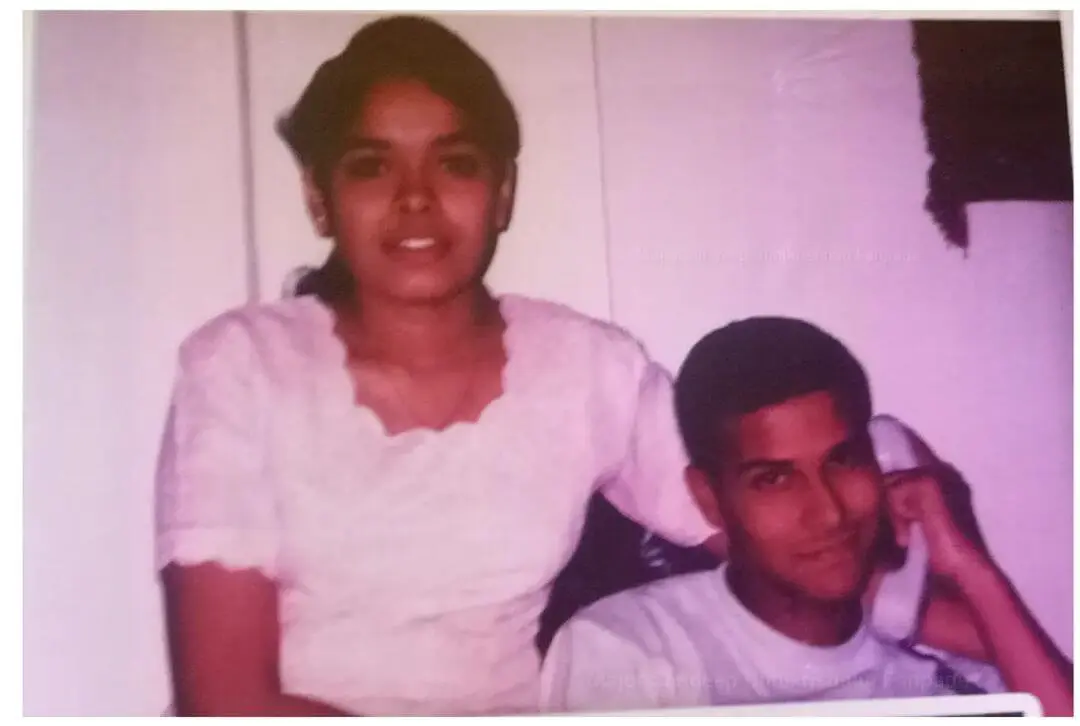

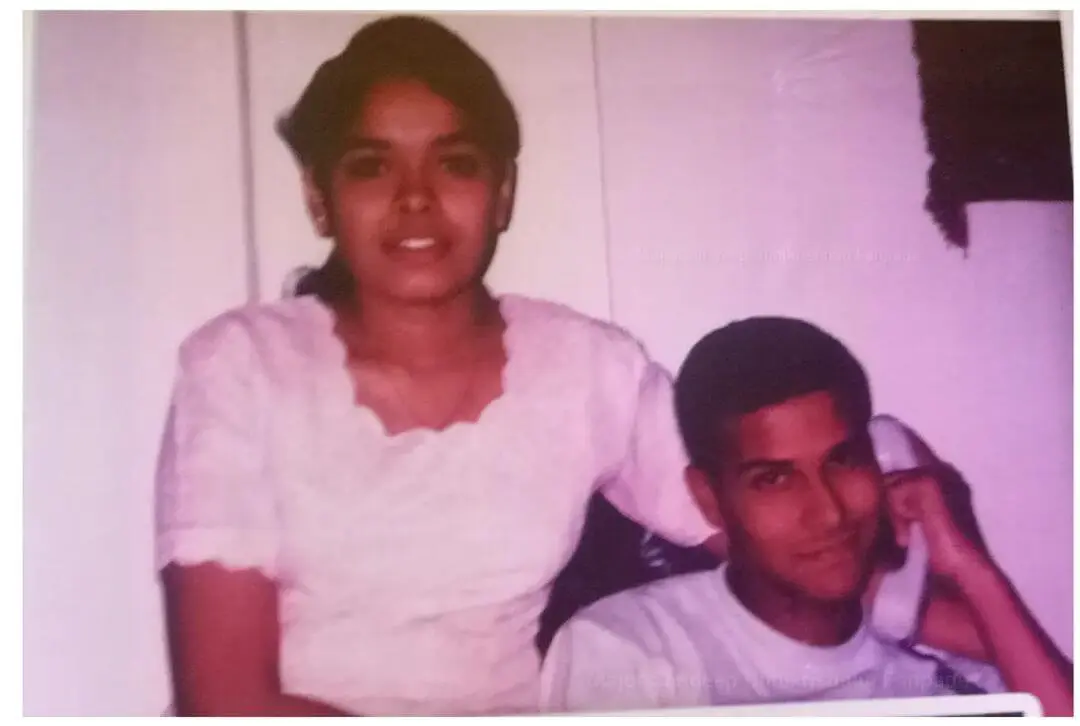

Neha and Sandeep Unnikrishnan’s Love Story

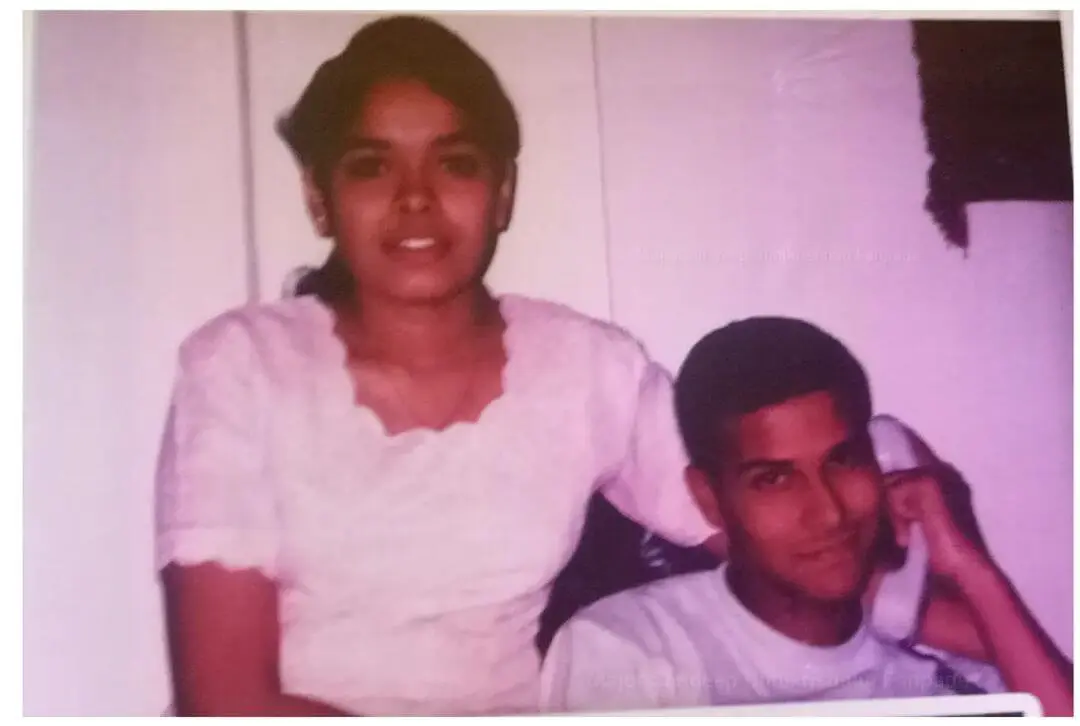

Neha Unnikrishnan was born in Kerala. Her family moved to Bangalore, where she joined the Frank Anthony Public School. Moreover, this is where she met Sandeep, and the two started developing a strong bond. She later married Sundeep Unnikrishnan.

They got married years after dating each other. But, soon after the marriage, they began to face issues in their personal life. It was mainly because Sandeep’s prime priority was to serve his country.

Additionally, there is no information about her children, and we cannot say much about this topic due to the lack of information. Also, there is not much shared in the movie or by her parents about her parents.

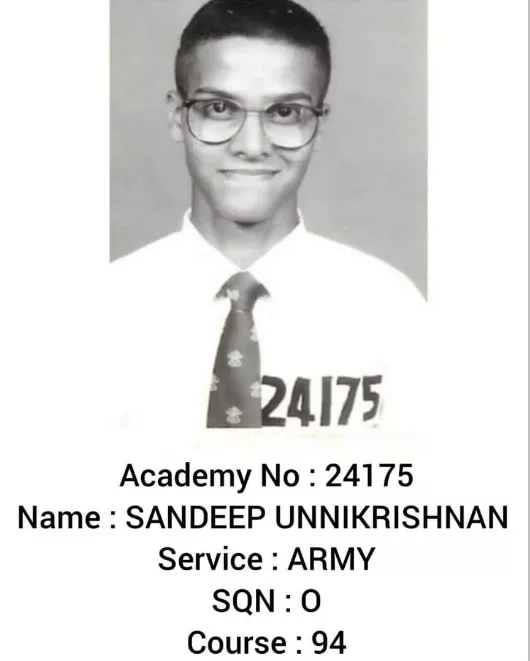

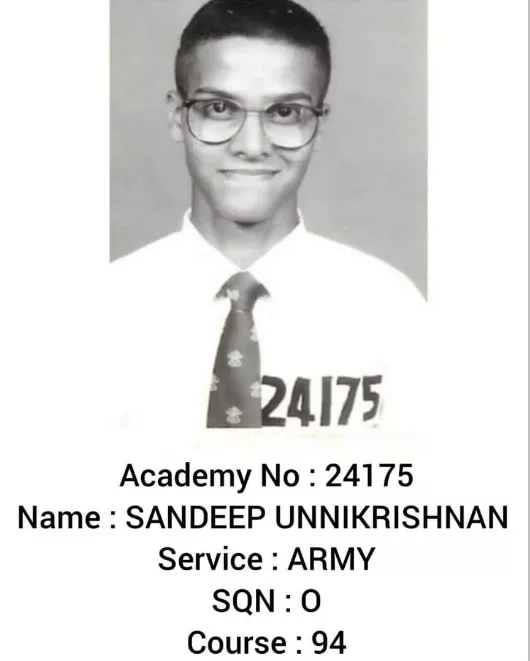

An Insight into Major Sandeep Unnikrishnan’s Life

Her husband ” Sandeep” belonged to Kozhikode, Kerala. However, the family of three moved to Bangalore when Sandeep was very young, years before she met Sandeep. Moreover, his father, K. Unnikrishnan, was a retired ISRO officer, while his mother, Dhanalakshmi Unnikrishnan, was a housewife.

Major Sandeep Unnikrishnan’s parents wanted him to pursue medicine; however, he was inspired by the naval forces and wished to join the navy. He has one sister named “Sandhya.” Yet, we do not know much about her Parents.

Major Sandeep Unnikrishnan: A Tribute from His School

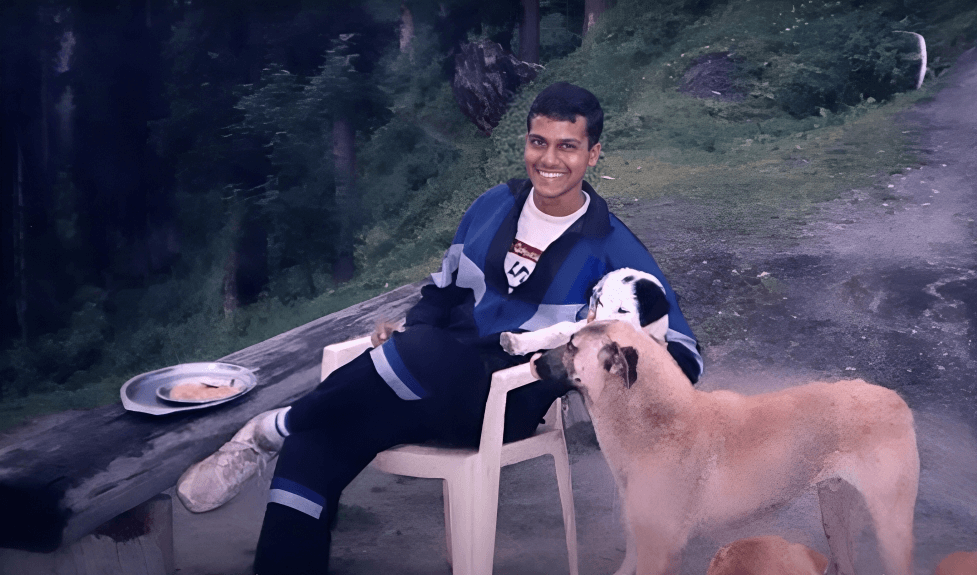

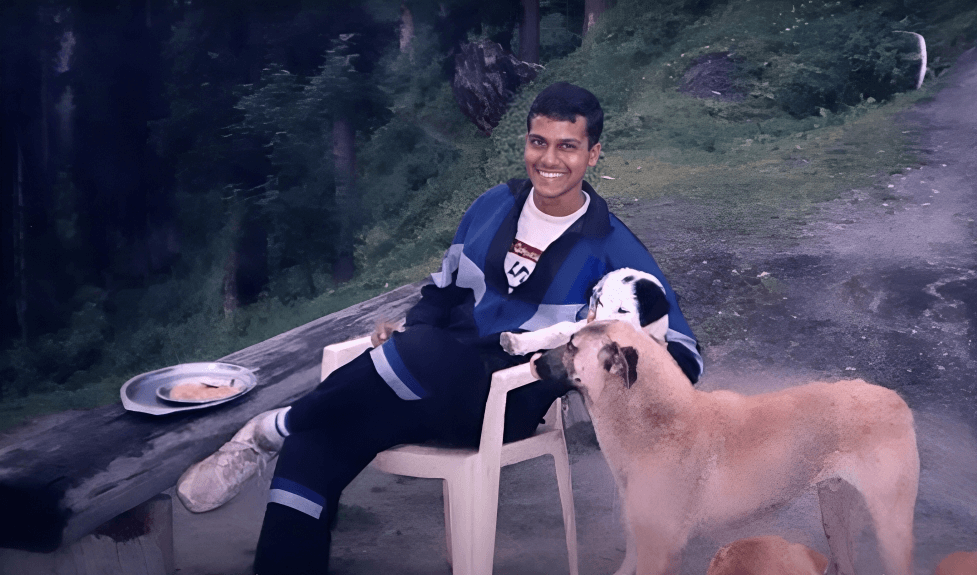

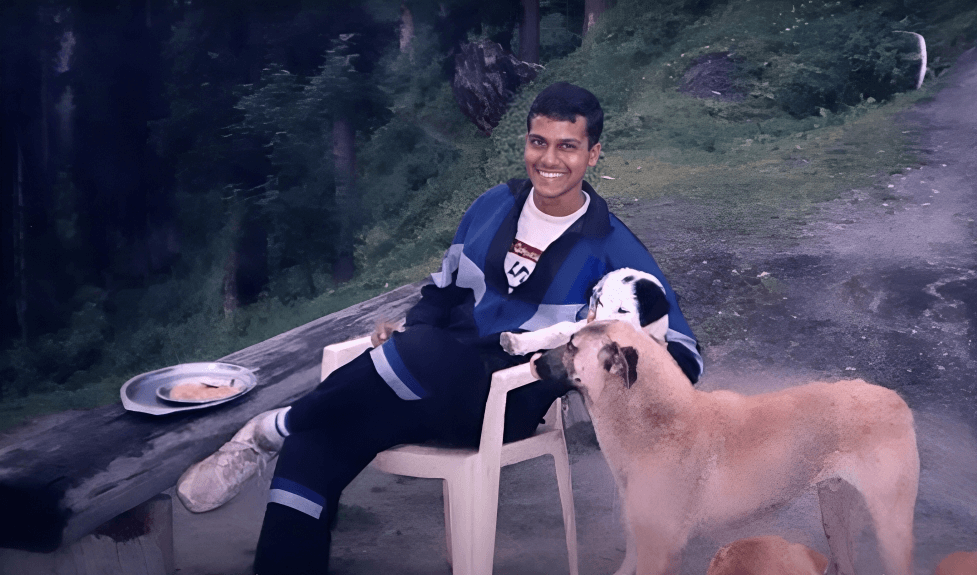

Major Sandeep Unnikrishnan, a hero known for his sacrifice during the Nariman House terrorist attack, spent 14 formative years of his life at the Frank Anthony Public School (FAPS) in Bangalore. He was a standout student and athlete known for his ambition to join the Army. He was a soft-hearted person and an animal lover.

Principal C Browne, who taught him, remembers Major Sandeep Unnikrishnan’s record is that of an exceptional student who excelled academically and in sports.

Despite his courage, he had a soft side and sang in the school choir. FAPS plans to honor his memory with a memorial assembly service, celebrating the life of their beloved schoolmate.

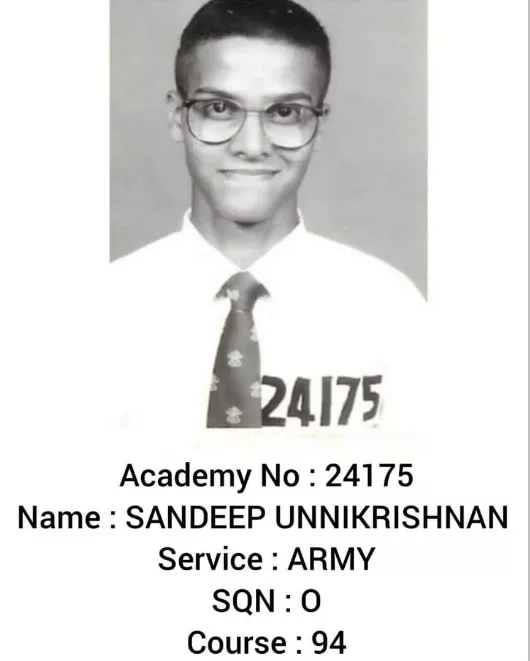

Fate had different plans for Sandeep, and he ended up getting selected for the National Defence Academy.

At the time of his death, Sandeep was serving as the training officer of the 51 Special Action Group of the National Security Guards.

What happened to Sandeep Unnikrishnan?

In November 2008, several spots in Mumbai became the target of a well-conspired terrorist attack led by Lashkar-e-Taiba, and the Taj Mahal Palace Hotel was also among them. Several people were trapped on the premises, and it became essential for the army to rescue them.

To tackle the situation, commandos from the National Security Guards were appointed. Moreover, the operation was led by Major Sandeep Unnikrishnan, who was also responsible for making the required strategies to enter the hotel with many like commando Sunil Kumar Yadav of Black Cat Commandos.

The Final Conversation: Major Sandeep Unnikrishnan’s Fateful Call on the Night of November 26

On the night of November 26, during the Mumbai terror siege, 31-year-old Sandeep Unnikrishnan made a heart-wrenching call to his sleeping father, urging him to turn on the television to witness the unfolding tragedy. This call marked their last conversation.

As NSG commandos initiated operations in Mumbai on Thursday evening, Sandeep Unnikrishnan’s father attempted to contact his son but was met with a friend named Sarvesh, who conveyed that Sandeep was on a secret mission in Mumbai. This left the family in suspense.

What happened inside the Mission?

Major Sandeep Unnikrishnan risked his life and led his team with extreme bravery and valor to save many hostages and many lives. Not only that, but he also made sure to protect them. He walked in front of the commandos and was shot several times. Even in such a condition, Sandeep did not lose his calm and rescued nearly fourteen hostages and saved commando Sunil Kumar Yadav, who was severely injured.

Upon reaching the upper part of the hotel, Sandeep decided to take the matter into his own hands. He directed his team to stay put and stopped them from coming up. By this time, he was severely injured and covered with blood.

Thus, he ended up sacrificing his own life for the nation. He successfully saved many hostages. While doing this, he also saved commando Sunil Kumar Yadav, who suffered many wounds in the battle.

The Nation Honors the True Martyr

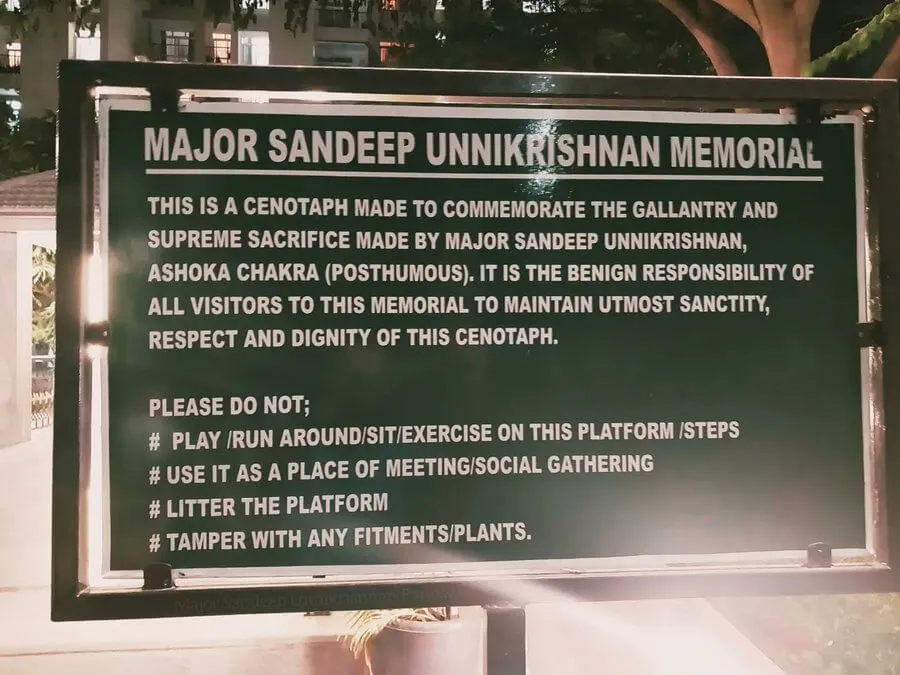

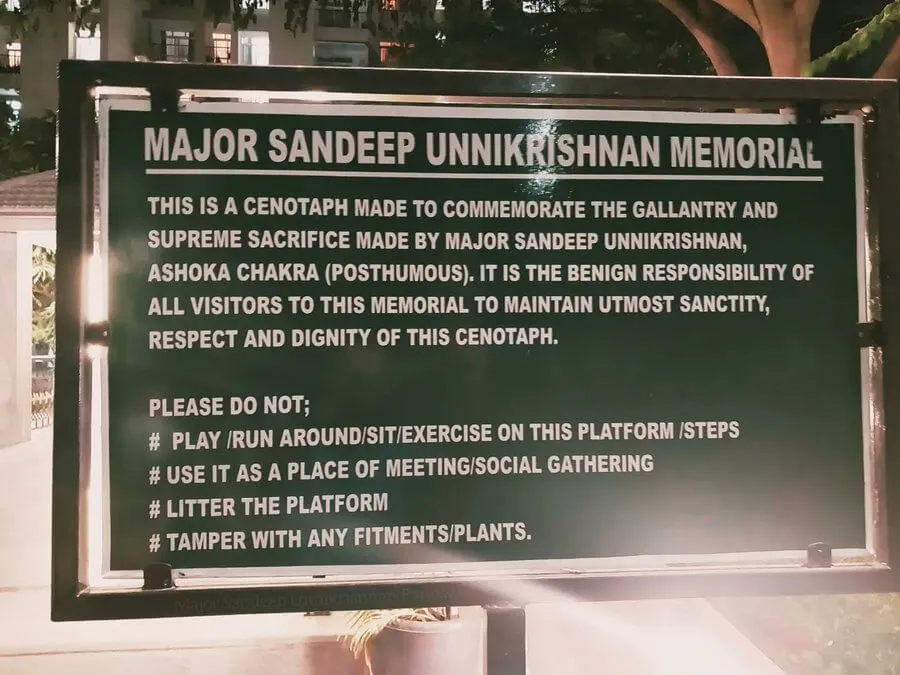

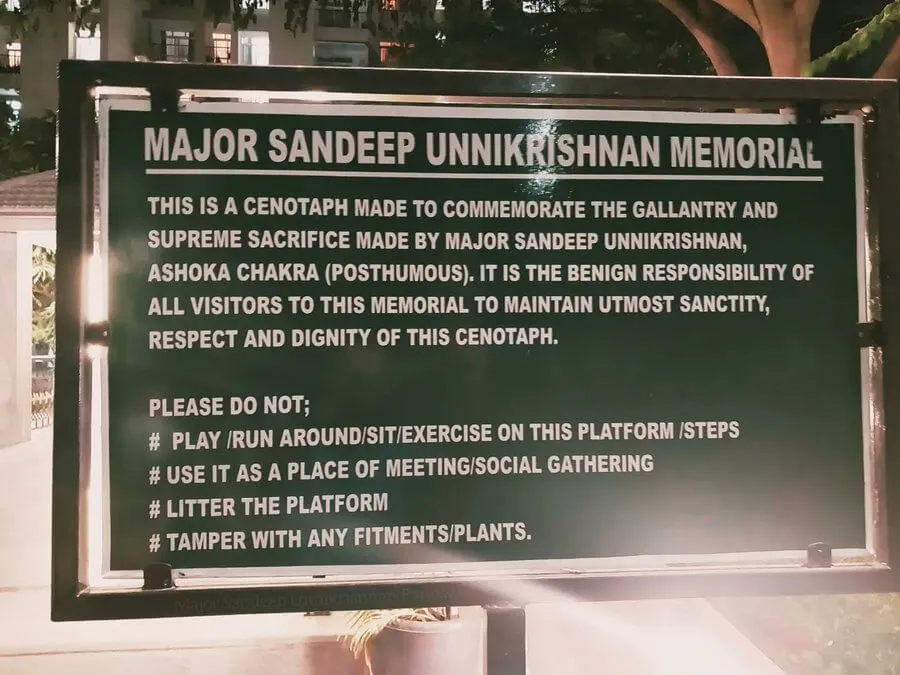

Sandeep’s name was written in golden letters in the history of India. The nation still remembers that Major Sandeep Unnikrishnan died for the country. A national hero who fought for his country till his last breath.

Sandeep Unnikrishnan risked his life, and his last rites were performed with military honors on 29 November and also remembered on Social Media.

The reports indicate that the weather in Bangalore turned gloomy on the same day, with clouds seemingly mourning the death of a young soldier. Neha Unnikrishnan was deeply upset by Sandeep’s death and has since stayed away from the public eye.

The country honored Major Sandeep Unnikrishnan for his sacrifice by naming Mother Dairy Double Road in Bangalore after him. Moreover, his bust is also installed on one of the junctions in Bangalore, which is renamed after him.

India’s highest peacetime gallantry award, Ashok Chakra, was given to Sandeep Unnikrishnan by the Government of India.

Her husband was a part of many high-profile army operations, including Operation Vijay, Operation Rakshak, and Operation Parakram.

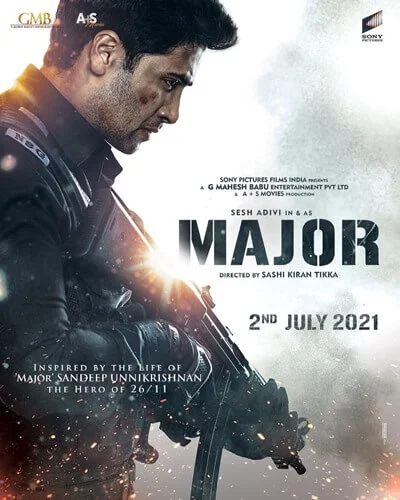

Is Major based on a true story?

Major Sandeep Unnikrishnan died for the love of his country. Thus, his contribution was honored with a biopic by the name of Major; it was released in 2022.

Who is Isha in the major movie? While Adivi Sesh portrayed his character in the movie, he impressed critics with his performance.

Who is Isha in the major movie?

The name of Neha Unnikrishnan is kept hidden in the movie. Neha, aka Isha’s role, is portrayed by Saiee Manjrekar. She was portrayed as Isha in the movie, as there is not much known about the whereabouts of his wife after the incident.

The film is a tribute to Sandeep’s sacrifice and showcases a determined soldier who is ready to risk it all for his country.

Sandeep Unnikrishnan spoke his last words bravely before Sandeep Unnikrishnan died in the 2008 Mumbai attacks. The words by Major Sandeep were,

“Don’t come up, I will handle them.”

Sandeep Unnikrishnan died for the nation, and his last words were engraved on his Crate. It is very hard to do that in a moment, though it seems easy to say so in a movie.

What is Major Sandeep Unnikrishnan’s wife Doing Now?

The young soldier lived and died with dire courage, leaving her proud. However, he left behind his mother, father, and wife. She is reported to be working as an architect; however, she has continued to maintain a low profile.

Is Neha Unnikrishnan married now?

We cannot say whether she is married or not, as there is not much information about her life. Moreover, there isn’t much information regarding her on the internet. There is also no information about Neha Unnikrishnan’s children. His parents claim that there were not any children from their marriage.

What happened to Neha after 15 years of 26/11 Mumbai Attacks?

After the 15 years of 26/11 Mumbai attacks, the Information about her current whereabouts and way of life is not readily available. Sandeep’s death upset her, and she has chosen to keep a low profile, likely due to the media attention and the tragic loss of her husband.

She decided to keep a low profile after her husband’s death and has chosen to live her life privately. There is no Instagram page and no social media account. She finds solace in the fact that her husband heroically saved hostages during the Mumbai attacks.

Does Neha Unnikrishnan have a child?

No, they were not having any kids when the attack happened. Major Sandeep Unnikrishnan’s wife is not publicly known, nor are her current occupation or activities. She has intentionally distanced herself from the public eye and media attention to lead a more private life away from social media.

Final Words

Neha Unnikrishnan was the wife of the brave Indian soldier Major Sandeep. Who lost his life while fighting a group of Pakistan-led terrorists in Mumbai’s 26/11 terror attacks. Not much is known about Major Sandeep Unnikrishnan’s wife at the moment.

As she prefers staying away from the public eye. You can find Neha’s unofficial Instagram page, but there is no update about the wife of a brave soldier.